We acquire real estate

secured investments

Pontus Capital is a private investment firm founded in 2009 to acquire and manage real estate secured assets, both properties and mortgages, on behalf of its private and institutional capital partners. We seek investments that earn superior risk adjusted returns by identifying unique opportunities in select markets and capitalizing on highly structured transactions with attractive relative values to mitigate downside risk.

Properties Acquired

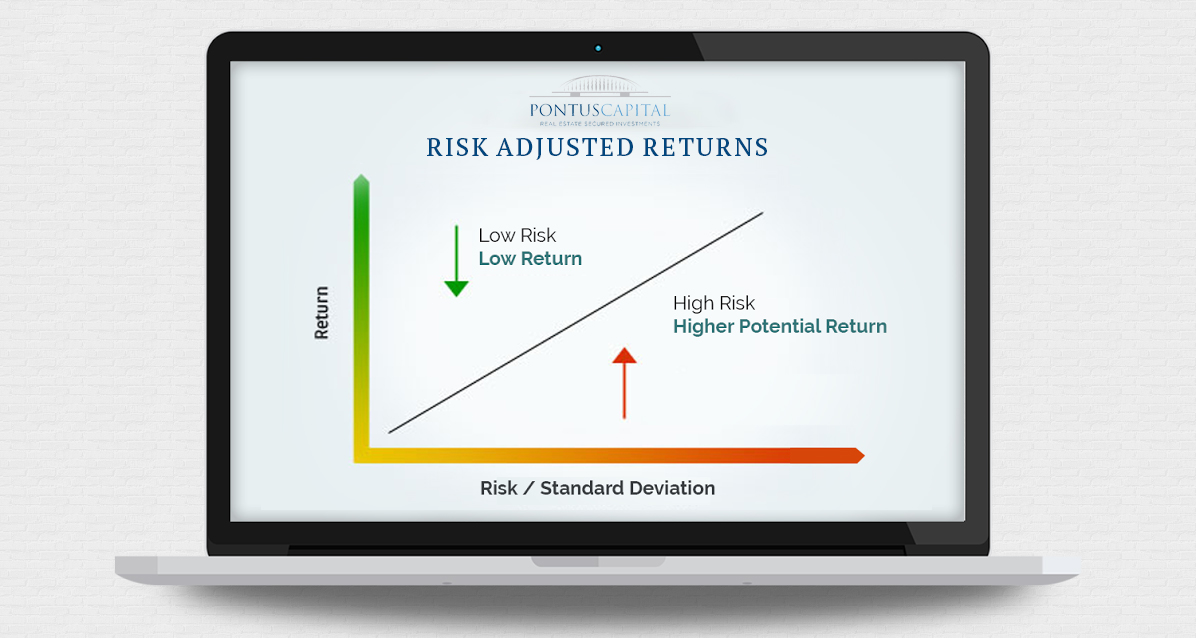

Risk adjusted returns &

Disciplined underwriting

Pontus Capital offers its investors current income and absolute return strategies through its commercial net lease and residential whole loan investment vehicles. Our dedicated team of real estate professionals and disciplined underwriting has enabled us to achieve consistent returns for our capital partners through a variety of market conditions. Pontus distinguishes itself through its access to deals, focused investment strategy and proven expertise to deliver solid results. Collectively, the principals of Pontus have purchased over $4 billion of commercial net lease and residential whole loans nationwide.

Institutional Quality Assets

We recognize and take seriously our fiduciary responsibility to our capital partners and will continue to provide a bridge between their capital and our institutional quality real estate secured investments.

A value-oriented private investment firm.

As a value-oriented private investment firm, Pontus Capital specializes in opportunistically purchasing real estate secured assets at attractive levels relative to intrinsic or marketed value. We leverage our extensive financing expertise, market knowledge and conservative underwriting to analyze, structure, and execute transactions that yield attractive risk adjusted returns for our investors. As a value-oriented investor, Pontus distinguishes itself by:

-

- Providing sophisticated financing solutions that meet seller objectives through highly structured transactions;

- Leveraging an extensive network of industry relationships to identify unique real estate investment opportunities;

- Adhering to disciplined, proven investment strategies that prioritize principal preservation;

- Creating certainty of performance as a buyer through quickly underwriting, approving, and closing transitions as demonstrated by our extensive track record through various market conditions; and

- Structuring customized investment vehicles that meet our capital partners’ objectives.

- Commercial real estate holdings 30%

- Residential real estate holdings 45%

- Commercial Mortgages 20%

- Residential Mortgages 5%

Strategy

Pontus Capital offers its investors current income and absolute return strategies through its respective commercial net lease and residential mortgage debt investment vehicles.

Absolute Return Strategies

Quidem rerum facilis est et expedita distinctio. Nam libero tempore, cum soluta nobis est eligendi optio cumque nihil impedit quo minus

Commercial Net Lease

Pontus invests in operationally essential real estate with long term, triple-net leases, providing multiple layers of protection that are designed to ensure stable cash flows in all economic conditions.

Residential Mortgage Debt

Pontus acquires and services non-performing residential whole loans to provide liquidity to lenders while generating above market returns to investors.

Executive Team

Pontus is managed by a team of seasoned real estate professionals with extensive underwriting, structuring, and asset management expertise.

Collectively, the Pontus team has over 50 years of experience and has completed over $4 billion of commercial and residential real estate transactions nationwide.

Michael Press

Managing Partner

Scott Stokas

Partner

Trevor Pohlman

Analyst

Yuriy Chavarha

Vice President - Acquisitions & Financing

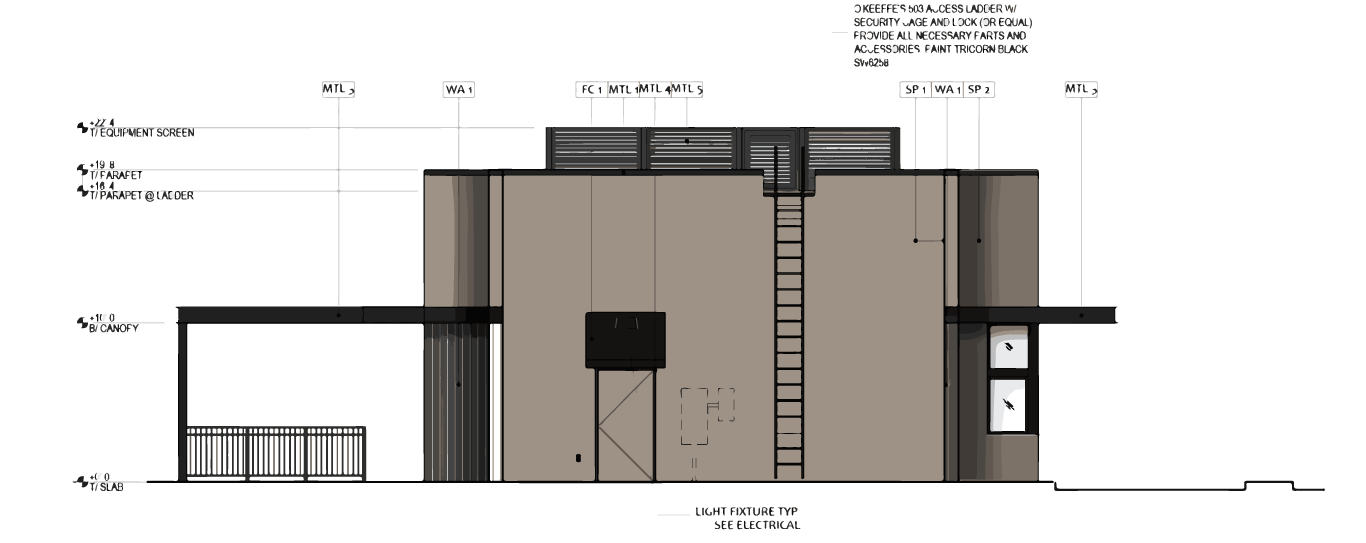

Selected Portfolio Assets

Valpak National Distribution / Industrial

465,769 Sq Ft. • 20.90 Acres

Schedule a Call to learn more Today

For questions regarding real estate, corporate business, or any other matters that may require our attention, please feel free to send us a message. We will respond to inquiries within the next business day.

Acquisitions

Scott Stokas

858-345-4544

sstokas@pontuscapital.com

Corporate Office

Pontus Capital

875 Prospect, Suite 303

La Jolla, CA 92037

Main: (888) 673-2513

Portfolio Management

858-356-5744

info@pontuscapital.com